Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - "Housing markets evolve, but the key to success is adapting to the shifts before they happen."

In today’s edition - The U.S. housing market faces new challenges as Trump pushes for lower costs, but local zoning laws, tariffs, and rising insurance premiums remain obstacles. Lumber tariffs threaten affordability, while single-family rent growth dips to a 14-year low at 1.5%. Meanwhile, co-ownership luxury real estate surges in Los Cabos, making high-end homes more accessible. In D.C., mid-term rentals are booming as short-term restrictions reshape the market. Get the latest insights on shifting real estate trends.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.05% | - |

15-Yr Fixed RM | 6.46% | - 0.01% |

30-Yr Jumbo | 7.32% | - 0.01 |

7/6 SOFR ARM | 6.87% | - |

30-Yr FHA | 6.46% | + 0.01% |

30-Yr VA | 6.48% | + 0.02% |

Average going rates as of Jan 31 2025

S&P 500 | 5,957.25 | - 1.81% |

Dow Futures | 44,158.00 | - 1.21% |

Bitcoin USD | 96,861.53 | - 4.25% |

Numbers as of Jan 31 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Trump’s path to lower housing costs has to navigate local concerns

Federal Housing Reforms Face Local Roadblocks - Trump’s executive order aims to cut regulatory costs, which account for 25% of new home construction expenses, but local zoning laws remain the biggest challenge in expanding supply.

Tariffs & Mortgage Fees Under Scrutiny - While reducing FHA mortgage insurance premiums could help buyers, proposed 25% tariffs on Canada & Mexico may raise construction costs, echoing 2018’s $9,000 per home lumber spike.

Insurance & Inflation Still Major Hurdles - Rising homeowner’s insurance costs in high-risk states like Florida & California remain a key affordability barrier, with industry groups urging disaster mitigation over premium cuts.

Bottom Line: While Trump’s housing affordability push has industry support, local zoning, supply chain costs, and insurance premiums will determine real impact on home prices.

🎢 Impact on Real Estate

Trump says America has ‘all the trees’ it needs. But fixing the housing crisis may mean depending on Canadian wood

Lumber Tariffs Threaten Housing Affordability - Trump’s 25% tariff on Canadian imports—which supply 30% of U.S. softwood lumber—could add $3B-$4B to construction costs. Builders warn this will increase home prices, making housing even less affordable amid an existing shortage.

U.S. Lumber Industry Faces Major Challenges - While America has 300 billion trees, ramping up domestic production isn’t simple. Sawmill expansions require regulatory approvals, new infrastructure, and skilled labor, which is already in short supply. Past attempts to scale saw lumber prices quadruple during the 2021 housing boom.

Will Policy Changes Help Offset Costs? - Builders and policymakers see an opportunity to streamline permits, reduce red tape, and boost domestic production. If regulations ease, it could help stabilize supply and mitigate rising costs, though relief may take years.

Bottom Line: The housing market braces for higher prices, but policy shifts and domestic production growth could soften the blow.

🎙️ RE Spotlight

US Annual Single-Family Rent Growth Dips Below 2%, Hits 14-Year Low

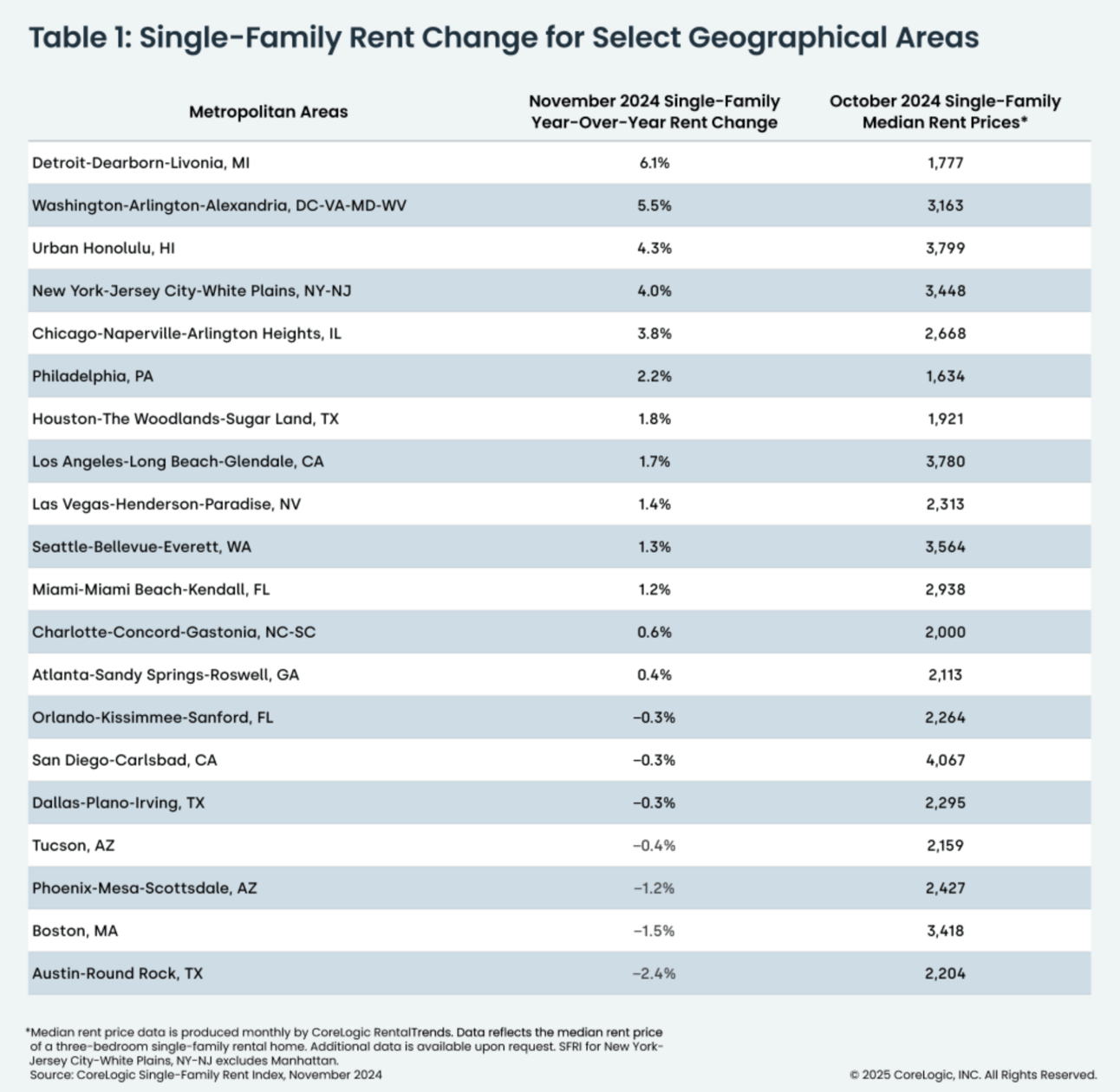

Annual Rent Growth Falls Below 2% for the First Time Since 2010 - U.S. single-family rent growth slowed to 1.5% year-over-year in November 2024, marking the lowest increase in 14 years, as wage growth outpaced rental costs.

Detroit Leads the Nation with 6.1% Rent Growth, While Austin Sees Declines - Detroit posted the highest rent surge (6.1%), while Austin (-2.4%), Boston (-1.5%), and Phoenix (-1.2%) saw annual rent declines, signaling shifts in demand across metro areas.

Luxury Rentals See Strongest Growth at 2.2%—Budget Rentals Lag Behind - Higher-priced rentals (125%+ of the regional median) grew 2.2% YoY, while lower-priced rentals (below 75% of the median) saw a slower 1.9% increase, reflecting affordability-driven trends.

Bottom Line: The rental market is shifting as growth slows nationwide, but select metros still see rising demand. Stay ahead with the latest insights!

🏰 RE State Zone

🏕️ Niche-RE

A new kind of luxury real estate in Los Cabos - The Rise of Luxury Co-Ownership

Co-Ownership is Gaining Traction in Los Cabos - Los Cabos ranks among the top three co-ownership markets in North America, as luxury homebuyers embrace fractional ownership models from companies like Pacaso, Ancana, and Lifestyle Asset Group.

Strong Demand Meets Rising Inventory - In the first three quarters of 2024, nearly 1,000 homes and condos sold totaling $1.13 billion, reflecting Los Cabos’ growing appeal for both primary and vacation home buyers.

Affordability Meets Luxury: Fractional Shares from $146K - Fractional ownership shares range from $146K to $869K, offering buyers access to high-end residences in Palmilla, Las Ventanas, and the East Cape—without the full cost of ownership.

Bottom Line: Luxury real estate in Los Cabos is evolving, making high-end second homes more accessible through co-ownership models while maintaining strong buyer demand.

The Evolving Rental Market in Washington, D.C.: Mid-Term Rentals Take Center Stage

Mid-Term Rentals Surge Amid Short-Term Restrictions - New D.C. regulations limiting short-term rentals have cut Airbnb/VRBO inventory by 75%, but mid-term stays (1-12 months) are thriving—driven by remote work, government contracts, and flexible travel trends.

Demand from Relocators, Renovators & Government Workers - D.C.’s federal workforce, embassy personnel, and relocating homebuyers fuel steady demand for turnkey furnished rentals, with properties catering to long stays seeing strong occupancy and revenue growth.

Adapting to Market Shifts with Strategic Pricing & Multi-Platform Exposure - Rental operators like LUXbnb are diversifying beyond Airbnb/VRBO, leveraging platforms like Furnished Finders, Sabbatical Homes, and direct bookings, while using dynamic pricing tools to optimize revenue.

Bottom Line: Mid-term rentals are emerging as a profitable alternative in D.C.'s evolving rental market, offering stability and opportunity despite regulatory changes.

🖼️ Chart-Tastic

How Americans Spend Their Money - Average Annual Expenditures $78K

👾 Interesting in Social

🌍 Dwelling of the Day

Custom-built modern rustic luxury home, completed in 2024. Perfect blend of elegance and charm.

Lot = 0.62 acres in Morganton, Georgia, 30560

3 Bed & 2 Bath, 1,584 Sqft. Asking $640K

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.