Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - Tariffs, Rising Costs, and Stubborn Rates Create Perfect Storm

Construction Costs Surge

Sellers Are Delisting, Not Discounting

Affordability Crisis Deepens

Recession Red Flags from Real Estate

New Jersey Real Estate in Transition

Quote of the day - Real estate is the heartbeat of communities, connecting people to places.

If you missed yesterday’s newsletter, click here

Mortgage & Stocks

30-Yr Fixed RM | 6.78% | + 0.01% |

15-Yr Fixed RM | 6.04% | + 0.01% |

30-Yr Jumbo | 6.90% | - |

7/6 SOFR ARM | 6.25% | - |

30-Yr FHA | 6.36% | + 0.01% |

30-Yr VA | 6.38% | + 0.02% |

Average going rates as of July 24th 2025 |

New? Join our newsletter – no cost!

🎢 Impact on Real Estate

Builders Under Pressure from Rising Costs & Tariffs Source: Reuters

Material costs rose 10% in some markets due to anticipated tariffs.

Spring selling season was one of the weakest since 2019.

Homeowners are remodeling instead of buying new, further reducing inventory turnover.

🎙️ RE Spotlight

Sellers Are Delisting, Not Discounting Source: Business Insider

47% YoY rise in sellers pulling listings rather than accepting lower prices.

High equity enables wait-and-hold strategy.

Potential inventory freeze if rates remain above 6.5%.

Affordability Crisis Deepens for Both Buyers & Renters Source: Manistee News

Median home price: $441,738, with mortgage payments averaging $2,570/month.

22.6M renters are cost-burdened (30%+ income spent on rent).

Homeownership rate declining, especially among millennials.

Housing Market Sending Recessionary Signals Source: MarketWatch

Moody’s flags real estate as a potential economic drag in H2 2025.

Price appreciation is flatlining in multiple metros.

Miami, Dallas, and Nashville may see 5–7% corrections.

🏰 RE State Zone

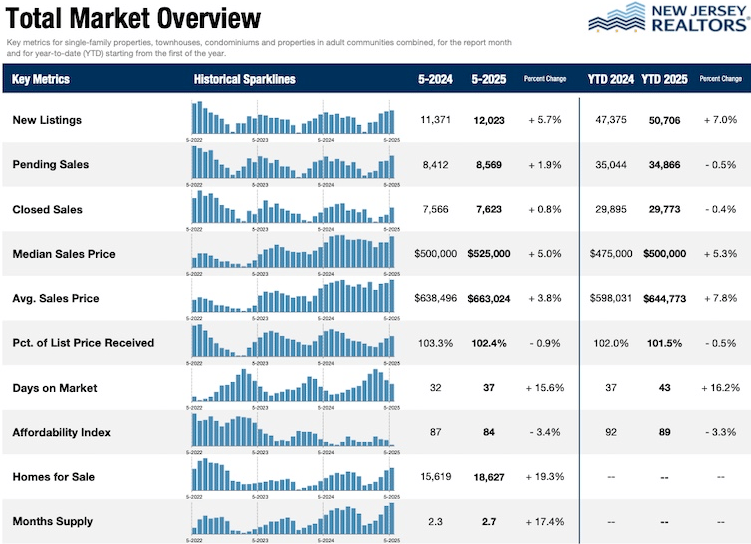

New Jersey Real Estate Highlights

Inventory Surges, Giving Buyers Leverage

📈 Listings up nearly 20% year-over-year: Central & North Jersey markets report a 19.3% surge in available homes in June New Jersey Real Estate Network

Balanced market emerging: With inventory rising and sales cooling, buyers gain more room to negotiate.

Longer Days-on-Market: Homes are taking slightly longer to sell—good news for price-sensitive buyers.

Home Prices Climb Steadily

Median home price now ~$582K, up 6.0% YoY in June Redfin

Bergen & Somerset counties continue hot: North Bergen saw sales soar 83% YoY; Fort Lee up 47% Redfin

Rapid suburban appreciation: Livingston hit a record $1.28M (+6.3% YoY); Englewood pared back slightly to $820K (~–10%) rightwayrealtygroup.com

Shore Region Holding Strong

Balanced supply at the shore: Atlantic County sits at 4.0 months of inventory; Cape May at 4.5 months

Price stability: Cape May median sale price ~$652,500; Atlantic County ~$398,500 Shore Real Estate Search

Fast sales: Days on market average 32 in Cape May and just 26 in Atlantic County—well below national average

🏕️ Niche-RE

Homebuilder Stocks Lag Broad Market

S&P Homebuilders index underperformed, down >6% YTD.

Weak sales and cost outlook weighed on earnings multiples.

Investors rotating to value and REITs.

Trade Tensions Threaten Profit Margins

Tariffs on steel, aluminum, copper could increase costs by 3–10%.

Builders may need to cut margins or raise prices—both risky.

Tariff volatility causing cautious forward guidance.

Multifamily Stocks Benefit from Construction Slowdown

New construction is 77% off peak, supporting existing assets' value.

REITs with stabilized occupancy may see rental leverage.

Investors eye regions with zoning restrictions and low new supply.

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.