Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - A great property isn’t found, it’s created with vision and passion.

In today’s edition - As economies pivot and power moves are made, China’s £1.1 trillion bailout shakes local markets while the U.S. sees record stock highs post-election. From soaring mortgage rates to eye-catching rental deals, global strategies and shifting trends redefine real estate and finance landscapes. Dive into what these changes mean for investors, renters, and homeowners in 2024 and beyond!

If you missed yesterday’s newsletter, click here

Dwellings Digest: In-Depth - Click to Read How Trump's Housing Policies Could Reshape Real Estate: What Buyers, Sellers, and Investors Need to Know

Rates & REITS

30-Yr Fixed RM | 6.92% | - 0.06% |

15-Yr Fixed RM | 6.37% | - 0.08% |

30-Yr Jumbo | 7.15% | - 0.05% |

7/6 SOFR ARM | 6.92% | - 0.03% |

30-Yr FHA | 6.30% | - 0.18% |

30-Yr VA | 6.32% | - 0.18% |

Average going rates as of Nov 8th 2024

S&P 500 | 5,995.40 | + 0.38% |

BitCoin USD (As of Nov 10th) | 79,750.94 | + 4.50% |

Gold | 2,691.70 | - 0.52% |

Numbers as of Nov 8th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

China's Bold £1.1 Trillion Bailout: Key Impacts on Debt, Growth, and Global Trade

China’s £1.1 Trillion Bailout Targets Local Debt Stability

China is focusing on stabilizing its economy through a £1.1 trillion bailout package aimed at local government debt restructuring. The move is expected to lower servicing costs by £66 billion, freeing resources for essential services.Market Disappointment Over Limited Consumer Stimulus

Investors were underwhelmed by the bailout’s limited measures for household spending support. Although beneficial for local finances, markets showed cautious optimism, with the renminbi weakening slightly post-announcement.Trade Tensions Add Pressure to China’s Economic Strategy

Facing potential 60% tariff hikes from the U.S., China’s package primarily addresses local debt concerns rather than stimulating growth. Analysts warn that unresolved trade frictions could further challenge China’s economic stability.

Stock Market Surges Post-Election: Big Gains, Fed Moves, and What's Next for Investors

Market Indexes Reach Record Highs After Election

Major indexes soared, with the S&P 500 and Dow Jones rising over 4.5%, and Nasdaq up nearly 6% last week, as investors anticipate favorable conditions under Trump's second term. Retail sales and inflation reports this week will shape market sentiment as traders assess potential future rate cuts.Big Tech Rallies on Policy Optimism and Reduced Regulation

Shares in Big Tech gained ground on expectations of lighter regulation. Amazon, Tesla, Nvidia, and others rallied in hopes of benefiting from Trump’s policy stance. Treasury yields also rose, with a "flight to quality" benefiting tech giants and underscoring investor optimism in the sector.Small Caps Surge but Face Earnings Concerns

The Russell 2000 posted its strongest week since April 2020, boosted by optimism over a favorable interest rate environment. However, with earnings estimates for small caps still declining, strategists urge caution, suggesting potential opportunities may unfold as earnings stabilize.

🎢 Impact on Real Estate

Mortgage Rate Trends Under Trump: What to Expect and Why it Matters

Mortgage Rates Decline Slightly After Election Surge

Following a pre-election peak at 7.13%, 30-year fixed mortgage rates have dipped to 6.92% as investors assess the potential impacts of Trump’s presidency. Expect rates to remain elevated if higher tariffs and additional tax cuts are enacted.Impact of Potential Trump Policies on Mortgage Rates

Investors anticipate that Trump's proposed 60% tariffs on Chinese goods and renewed tax cuts may drive inflation, prompting higher mortgage rates. Markets are watching closely, with volatility expected as policy details emerge.Fed's Approach and Economic Data Remain Key Factors

Should economic data weaken significantly, the Fed may cut rates further to stabilize the economy, potentially easing mortgage rates. Conversely, rapid tariff implementation could increase inflation, compelling the Fed to keep rates elevated to counteract rising prices.

🎙️ RE Spotlight

38% of Voters Say Housing Affordability Impacted Their Presidential Pick

Key Highlights from the NAR’s Q3 Housing Market Report

Homeowner Wealth Surges with Midwest Markets Leading

The average U.S. homeowner gained $147,000 in equity over the past five years, and nearly 90% of major metros posted annual home price gains. Midwest cities, including Racine, WI, and Youngstown, OH, saw impressive double-digit growth, with Illinois metros like Peoria and Springfield also seeing notable increases.

Slight Improvement in Housing Affordability as Rates Ease

Mortgage rates fell from last year's peak, averaging in the mid-6% range. With rising wages outpacing home price growth, monthly payments on single-family homes dropped 2.4% year-over-year, signaling a slight improvement in affordability for new buyers.

California Dominates Most Expensive Markets with Double-Digit Growth in Some Areas

California remains home to the priciest markets, with San Jose leading at $1.9 million. While Honolulu, HI, and several California metros, like Anaheim and Los Angeles, saw annual price increases above 5%, Boulder, CO, was one of the few high-cost areas with a 3% decline.

🏕️ Niche-RE

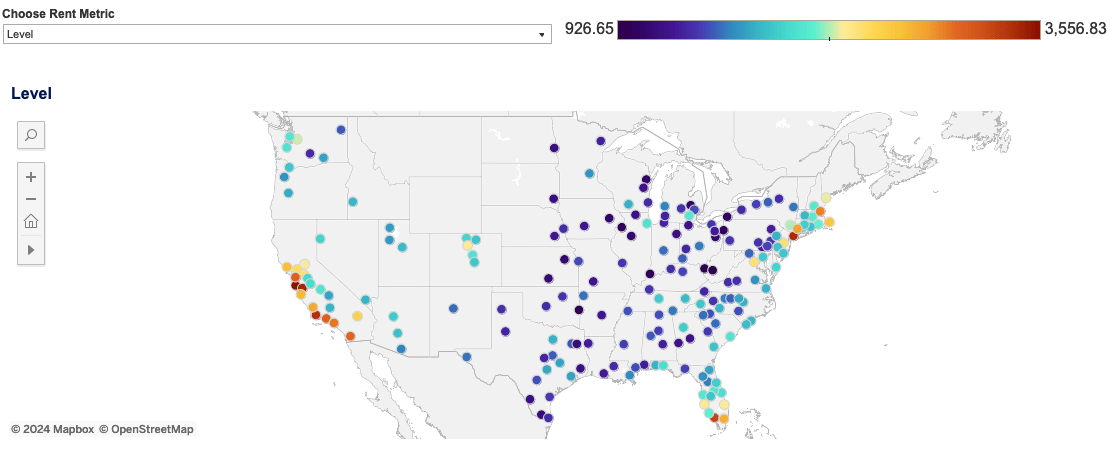

October 2024 Rental Market Trends & Insights

Notable Decline in Rental Demand Reflects Broader Market Softening

This October, typical seasonal rent decreases were double the usual rate, pointing to a shift beyond just seasonality. With over 55,000 new apartments completed last month—a 50-year high for this period—rising vacancy rates have brought increased concessions, now present in 37.7% of listings. This suggests renters will see more competitive offers into November, including rent-free periods and parking deals.

Rent Growth Holds Steady Despite Weaker Multifamily Demand

U.S. rental rates remain resilient, posting a 3.3% annual growth. However, multifamily growth trails at just 2.3% due to surging supply. San Antonio and Austin show yearly rent declines, while affordability pressures are strongest in Miami and New York, where renters spend over 40% of their income on housing. Single-family rents lead with a 4.3% increase, reflecting stronger demand for this segment.

Rental Concessions Surge as Vacancy Rates Hit Post-Pandemic Highs

With Zillow's Observed Renter Demand Index at record lows and vacancy rates reaching 6.9%, landlords have responded with unprecedented concessions. Major metros like Louisville and Raleigh saw significant annual increases in these offers, creating favorable conditions for renters nationwide. As supply grows, renters can expect more competitive deals in the months ahead.

🖼️ Chart-Tastic

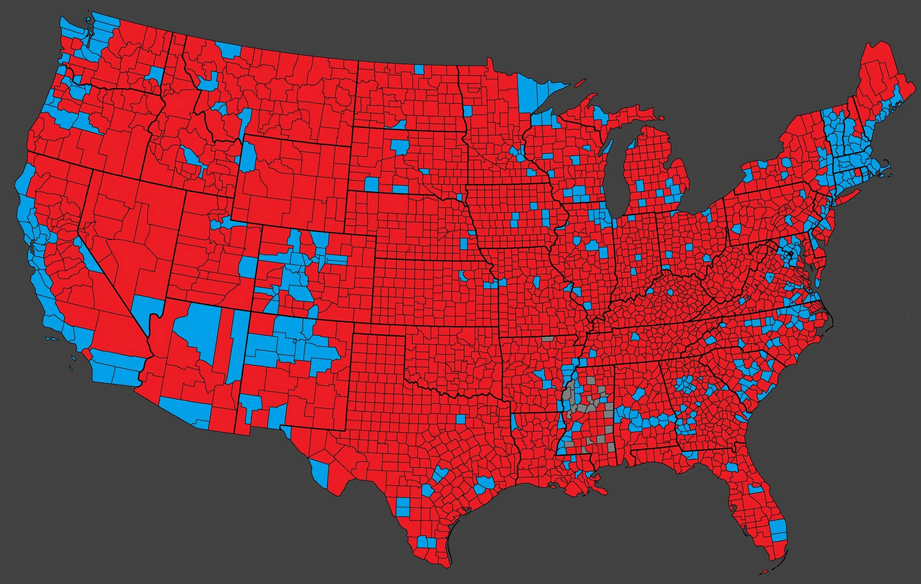

America Has Spoken - The People Voted for Major Government Reform

👾 Interesting in Social

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.