Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - A home is where love resides, memories are created, and life unfolds

In today’s edition - Inflation remains elevated, complicating the Fed’s path to rate cuts, while jobless claims rise due to hurricane disruptions. Wall Street reacts cautiously to inflation and unemployment data. U.S. home sales surge, except in hurricane-affected Florida, as mortgage rates influence buyer interest. National rents continue to decline amid rising supply, while foreclosures drop, though risks remain in key states. KKR's acquisition of The Parking Spot highlights travel sector growth, and Brooklyn’s housing market sees intense bidding wars and record-high prices as cash buyers dominate.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.62% | - 0.05% |

15-Yr Fixed RM | 6.16% | - 005% |

30-Yr Jumbo | 6.75% | - 0.04% |

7/6 SOFR ARM | 6.56% | - 0.04% |

30-Yr FHA | 6.12% | - 0.06% |

30-Yr VA | 6.15% | - 0.05% |

Average going rates as of Oct 10 2024

S&P 500 | 5,834.25 | + 0.09% |

Bitcoin | 60,212.18 | - 0.32% |

Numbers as of Oct 10 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Inflation Battle Continues: Fed's Path to Rate Cuts Faces New Challenges

Stubborn inflation persists: The Consumer Price Index exceeded expectations in September, with core inflation rising to 3.3%, above the Fed's 2% target, indicating that price pressures remain despite the Fed's tightening efforts.

Jobless claims spike: Unemployment claims surged to 258,000 last week, the highest in recent months, but economists attribute this to temporary disruptions from hurricanes rather than a worsening job market.

Rate cuts still expected: Despite inflation running hotter than expected, economists and traders remain confident that the Fed will proceed with its anticipated 25 basis-point rate cut in November, aiming for a soft landing without triggering a recession.

Wall Street Declines Amid Inflation and Unemployment Data as Investors Weigh Fed’s Next Move

Inflation hotter than expected: The Consumer Price Index (CPI) rose 0.2% in September, bringing the year-over-year rate to 2.4%, slightly above expectations. Core inflation, excluding food and energy, hit 3.3%, reinforcing concerns about persistent inflation.

Jobless claims surge: Unemployment claims jumped to 258,000, much higher than the forecasted 230,000, signaling potential labor market softness amid inflation concerns.

Fed’s path forward unclear: Despite the mixed data, traders are pricing in an 80% chance of a 25 basis-point interest rate cut in November, while some Fed officials suggest holding rates steady due to recent economic "choppiness."

🎢 Impact on Real Estate

U.S. Home Sales Surge, Except in Coastal Florida Amid Hurricane Disruptions

Sales on the rise: Pending U.S. home sales increased by 2% year-over-year for the four weeks ending October 6, marking the largest uptick in three years, as falling mortgage rates pulled buyers back into the market.

Coastal Florida struggles: Hurricane Helene contributed to a sharp drop in pending sales in Florida metros like West Palm Beach (-17.6%) and Tampa (-15.5%), where natural disasters and rising insurance costs are dampening buyer activity.

Rates may shift momentum: While mortgage rates rose to 6.62% on Monday after a strong jobs report, demand still holds, but rising rates could moderate homebuyer interest in the coming weeks.

🎙️ RE Spotlight

October 2024 Rent Report: A Cooling Market Amid Rising Supply

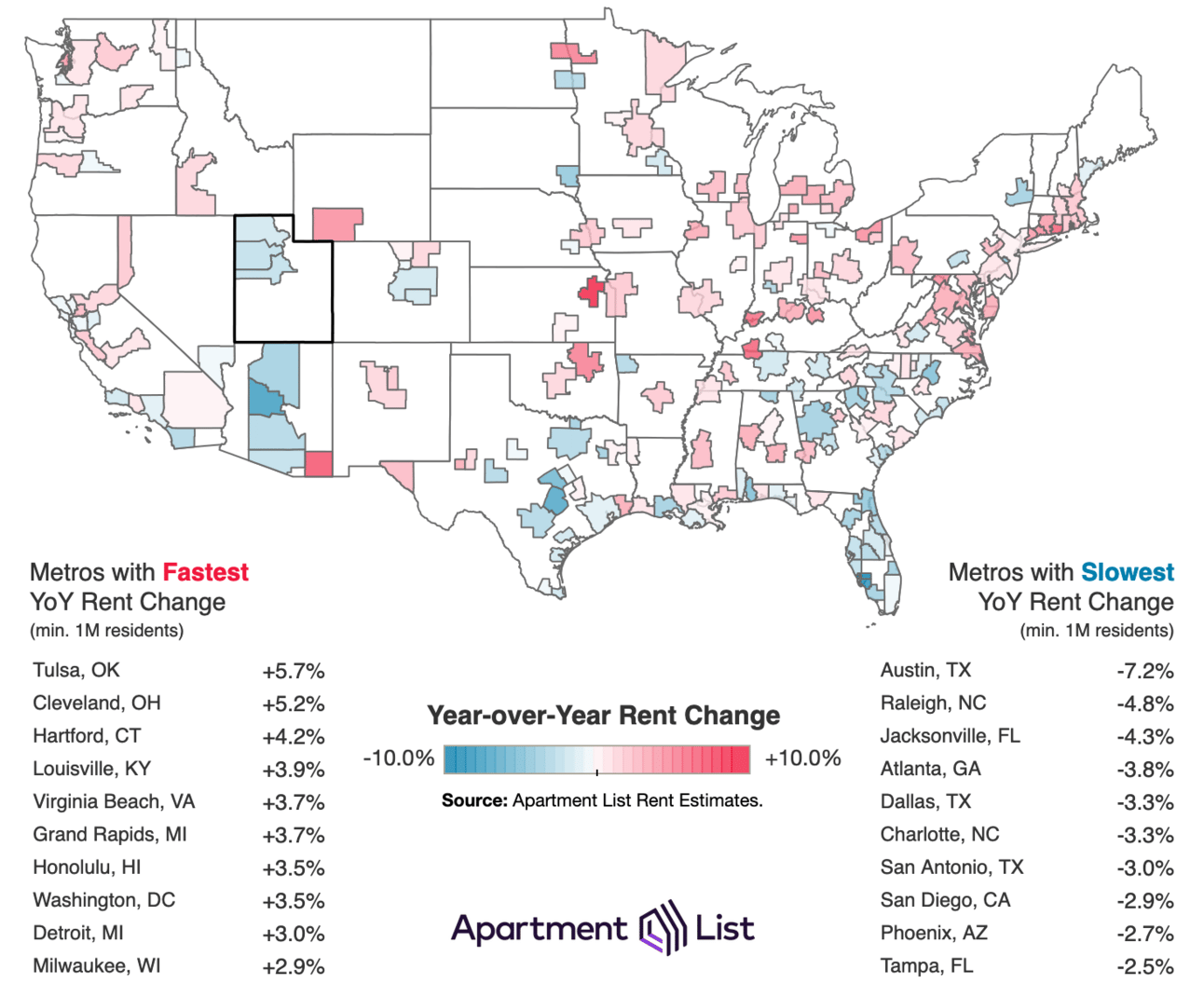

National rents drop 0.5% as supply outpaces demand: The median rent fell to $1,405, signaling a cooling market driven by increased multifamily construction and easing occupancy rates.

Year-over-year rent growth remains negative at -0.7%: For over 18 months, rents have trended downward, with Sun Belt metros like Austin seeing the sharpest declines due to rapid apartment completions.

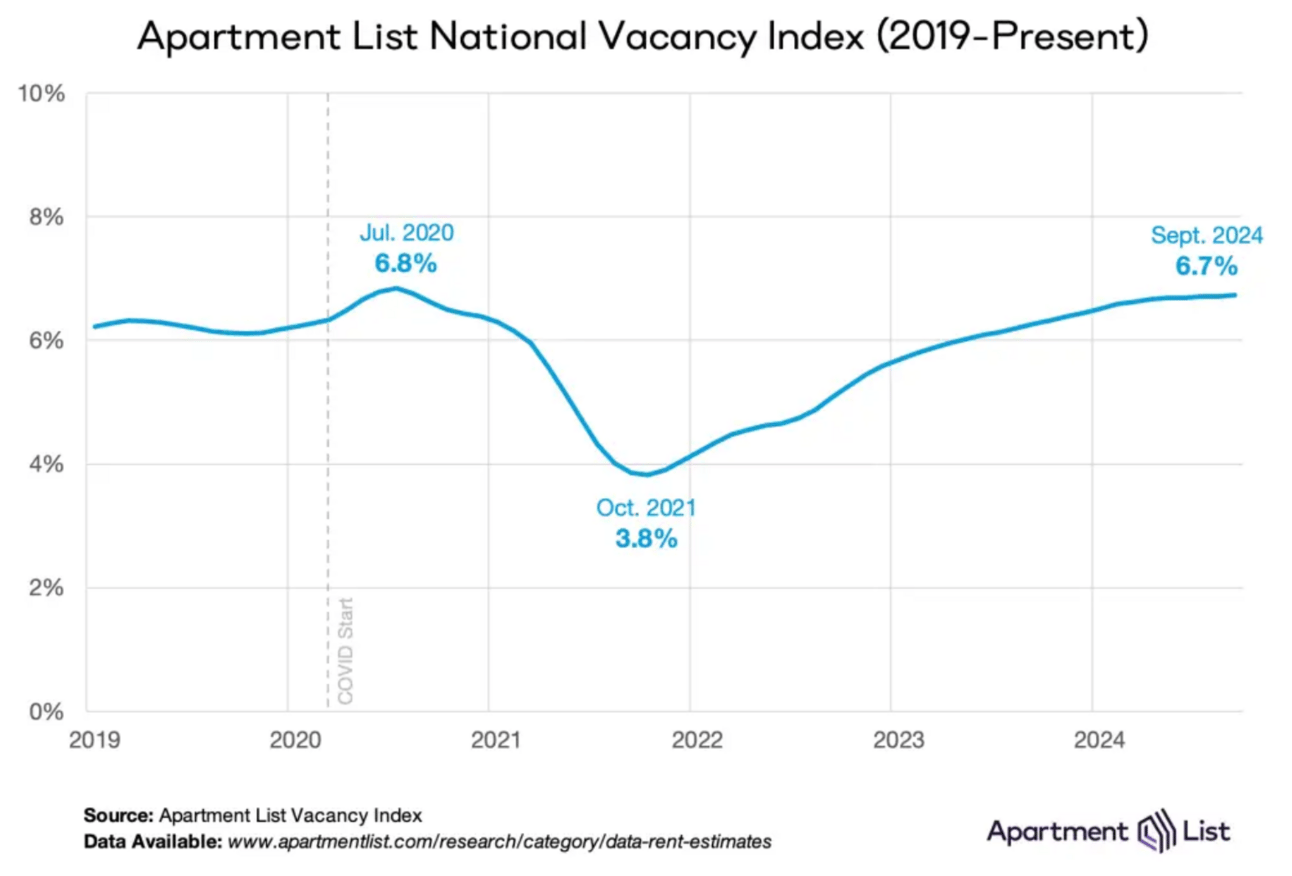

Vacancies rise to 6.7%, the highest since 2020: With new units flooding the market, renters now have more options, particularly in cities with booming construction activity, which is expected to extend into 2025

U.S. Foreclosure Activity Drops in Q3 2024, But Localized Risks Remain

Foreclosures down across the board: U.S. properties with foreclosure filings totaled 87,108 in Q3 2024, a 2% decrease from the previous quarter and a 13% drop from the same time last year, signaling overall market stability.

Localized risks in key states: Despite national improvements, foreclosure rates remain highest in Illinois, Nevada, and Florida, with one in every 904 housing units in Illinois facing foreclosure.

Foreclosure starts slow, but vigilance required: While foreclosure starts dropped in key states like North Carolina (down 44%) and Georgia (down 29%), economic shifts or interest rate changes could impact future trends.

🏰 RE State Zone

🏕️ Niche-RE

KKR Acquires The Parking Spot, Betting on Airport Travel Growth

KKR acquires The Parking Spot to expand in the booming travel sector: The private equity giant purchased the largest near-airport parking operator, boasting 47 lots near 28 major U.S. airports, betting on increased demand for travel-related infrastructure.

Travel sector rebounds with record passenger and hotel demand: U.S. airlines hit an all-time high with 89.8 million passengers in June 2024, while summer hotel demand ranked among the top three since 2000, fueling confidence in related services like airport parking.

The Parking Spot to thrive under KKR’s leadership: With KKR’s resources and industry expertise, The Parking Spot is well-positioned for future growth, continuing to offer affordable and convenient parking options outside of major airport hubs.

Brooklyn's Housing Market Heats Up: Cash Sales, Bidding Wars, and Record-High Prices

Cash reigns supreme: Over half of Brooklyn's home purchases in Q3 2024 were cash transactions, the highest share in a decade, with cash sales up 20% year-over-year, signaling buyers' response to elevated mortgage rates.

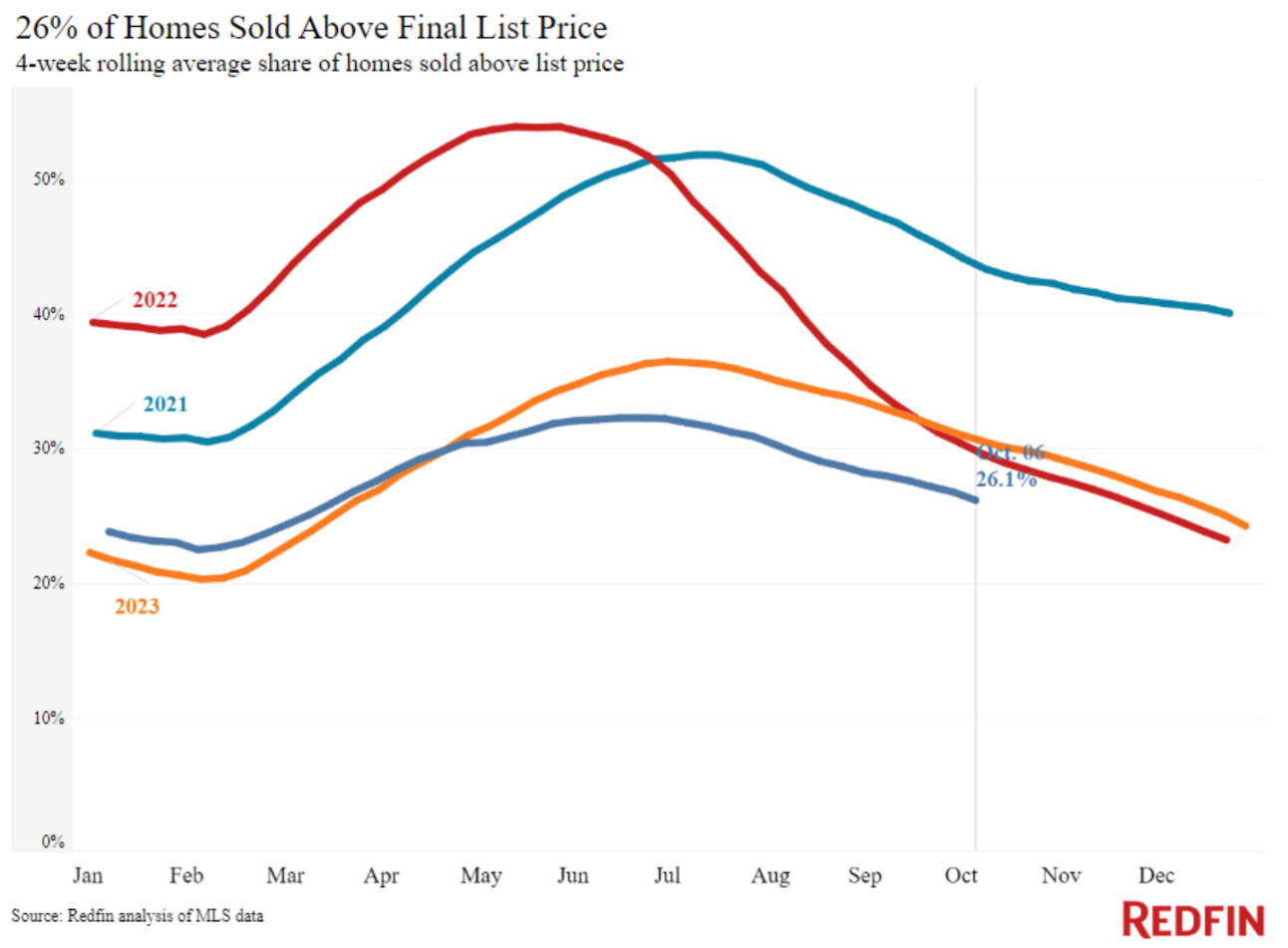

Bidding wars intensify: One in four Brooklyn home sales involved a bidding war, with properties selling for an average of 6% above the asking price, marking the highest competition level in two years.

Price growth continues: Brooklyn's median home price hit $975,000 in Q3, a 4% annual increase, driven by rising demand and limited inventory, setting the stage for potential new records in Q4.

🖼️ Chart-Tastic

🌍 Designer ShowHouse 2024

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.