Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Real estate evolves, driven by shifting priorities, market dynamics, and the timeless pursuit of a place to call home”

In today’s edition - I dive into the Federal Reserve's tempered rate cut projections and their ripple effects on real estate. Explore how stabilizing mortgage rates and surging listings signal market shifts. Discover why guest bedrooms are the new real estate luxury and how senior migration is reshaping multifamily housing trends. Plus, spotlight deals on charming $300K homes across Kansas, Virginia, and New Jersey.

If you missed yesterday’s newsletter, click here

Rates & Market

30-Yr Fixed RM | 7.14% | + 0.01% |

15-Yr Fixed RM | 6.45% | + 0.03% |

30-Yr Jumbo | 7.30% | + 0.05% |

7/6 SOFR ARM | 7.03% | + 0.05% |

30-Yr FHA | 6.50% | + 0.08% |

30-Yr VA | 6.52% | + 0.07% |

Average going rates as of Dec 19 2024

S&P 500 | 5,867.08 | - 0.09% |

Bitcoin USD (As of Dec 19) | 97,406.45 | - 2.74% |

Tesla | 436.17 | - 0.90% |

Numbers as of Dec 19 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Federal Reserve’s Cautious Rate Path Sparks Market Volatility Amid Inflation and Policy Uncertainty

Reduced Rate Cut Projections: The Federal Reserve now forecasts just two rate cuts in 2025, down from four predicted earlier, citing persistent core inflation and upgraded economic growth projections.

Market Volatility Indicators: The S&P 500 dropped by 0.09% on Wednesday, reflecting investor concern over Powell’s acknowledgment of heightened policy uncertainty and slower-than-expected rate reductions.

Hyper Data Dependency: The Fed’s 2025 strategy hinges on real-time economic indicators like jobs and inflation reports, signaling a reactive stance amidst unpredictable economic and administrative policies.

🎢 Impact on Real Estate

More Sellers Are Listing Their Homes, Hoping to Cash in on High Prices and Demand From Buyers

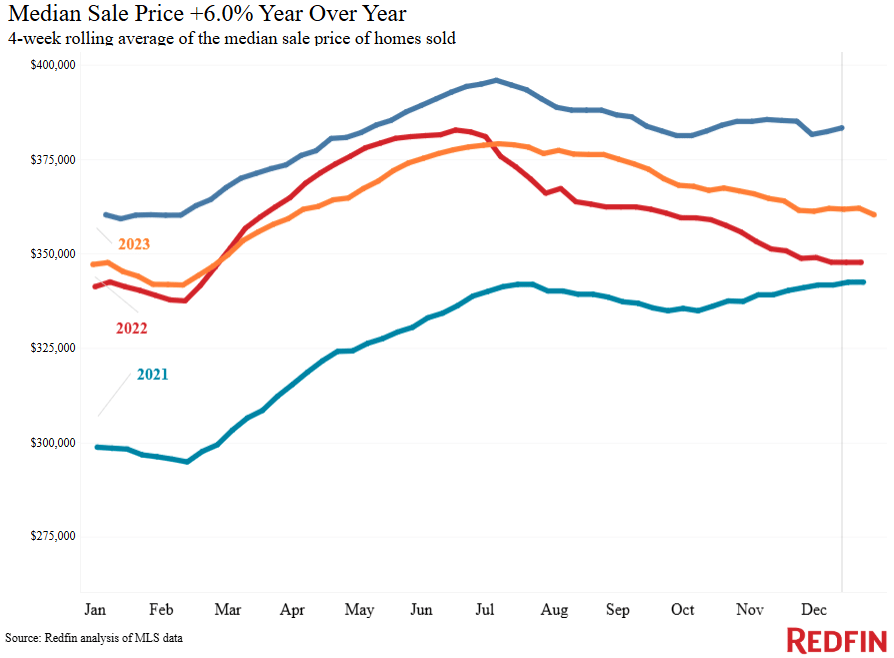

Listings Surge Amid Rising Prices: New home listings jumped 7.6% year-over-year, as sellers respond to a 6% increase in median home prices and growing consumer confidence.

Buyers Reignite Demand: Redfin’s Homebuyer Demand Index rose 9% year-over-year, and mortgage-purchase applications spiked 18% month-over-month, signaling stronger buyer activity.

Mortgage Rates Drive Decisions: Declining rates to a two-month low of 6.6% brought buyers back, though the Fed’s recent announcement hints at potential stability near current levels.

🎙️ RE Spotlight

Homebuyers With Kids Are Twice As Likely to Get Family Help For Down Payments Than Those Without Kids

America’s Households Are Shrinking, Ushering in the ‘Golden Age’ of Guest Bedrooms

Guest Room Boom: U.S. homes boast 31.9 million spare bedrooms, quadruple the number in 1980, with a record-high 8.8% share of all bedrooms classified as guest rooms.

Smaller Households, Bigger Spaces: Shrinking household sizes—from 3.1 in 1970 to 2.5 in 2023—and steady 2.8 bedrooms per home fuel the surplus in spare rooms.

Regional Trends: The Mountain West leads with Ogden, UT, claiming the top spot for guest bedrooms (12.2% of total), while urban hubs like Miami and NYC lag behind.

🏰 RE State Zone

Leavenworth, Kansas

Price: $300,000

Style: Queen Anne Revival (1872)

Size: 2,613 sq. ft.

Price per Sq. Ft.: $115

Features:

3 beds, 1.5 baths

Updated kitchen with granite counters

Stained glass windows, hardwood floors

Backyard with patio, mature tree, and garage

Location Highlights:

Near Leavenworth Landing Park, Fort Leavenworth, and Kansas City (40 min drive)

Taxes: $2,028

Richmond, Virginia

Price: $297,000

Style: 1960 Ranch House

Size: 1,142 sq. ft.

Price per Sq. Ft.: $260

Features:

3 beds, 1.5 baths

Fireplace, hardwood floors

Updated kitchen with granite counters

Fenced backyard with patio and garden boxes

Location Highlights:

Near Brookland Park Boulevard, The Diamond Stadium, and downtown Richmond (15 min drive)

Taxes: $3,252

Trenton, New Jersey

Price: $299,000

Style: 1900 Rowhouse

Size: 1,332 sq. ft.

Price per Sq. Ft.: $224

Features:

2 beds, 1.5 baths

Exposed brick, stained glass accents

Kitchen with premium appliances

Rooftop deck and patio with garden

Location Highlights:

Near Trenton rail station, State House, and Patriots Theater

Access to Philadelphia (30 min by train)

Taxes: $5,889

Quick Insights

Best Value (Size): Leavenworth, KS, at $115/sq. ft.

Coziest Charm: Trenton, NJ, with exposed brick and a rooftop deck.

Move-In Ready Updates: Richmond, VA, featuring new roof, gutters, and fresh paint.

🏕️ Niche-RE

2025 Multifamily Housing Trends: Supply Challenges, Rent Relief, and Rising Retention Strategies

Record Supply Meets Stabilizing Demand: The U.S. saw a net increase of 500,000 apartment units in 2024, the highest since 1974, keeping occupancy steady at 94.3% and boosting lease renewals to an impressive 55%.

2025 Supply Shift Forecast: Developers face economic challenges as multifamily starts decline to early 2013 levels, signaling potential housing shortages in select metros beyond 2025.

Regional Rent Trends: Sun Belt metros with high supply will see modest rent growth and concessions, while lower-supply regions are poised for growth akin to the 2010s decade average.

What Senior Migration Means for Multifamily Housing

Aging Population Driving Housing Demand: The 80+ demographic grew by 4.4% in 2023, with one in five Americans projected to be 65+ by 2050, fueling senior housing and suburban market trends.

Migration Shifts Influence Rent Growth: Sun Belt states remain top destinations, but rents in senior housing increased 15-20% above the national average in 2024 due to limited new supply and strong demand.

Evolving Preferences Redefine Senior Living: Baby Boomers prioritize health-optimized homes, multigenerational living, and suburban accessibility, delaying traditional senior housing for independent living options.

🖼️ Chart-Tastic

👾 Interesting in Social

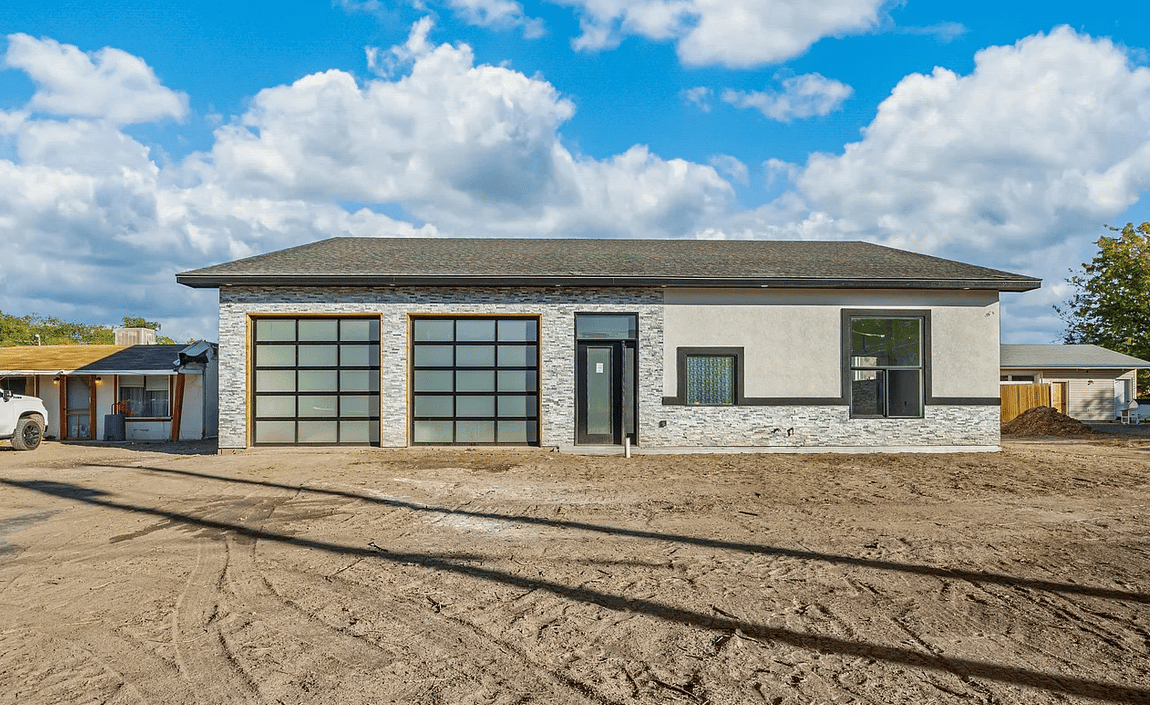

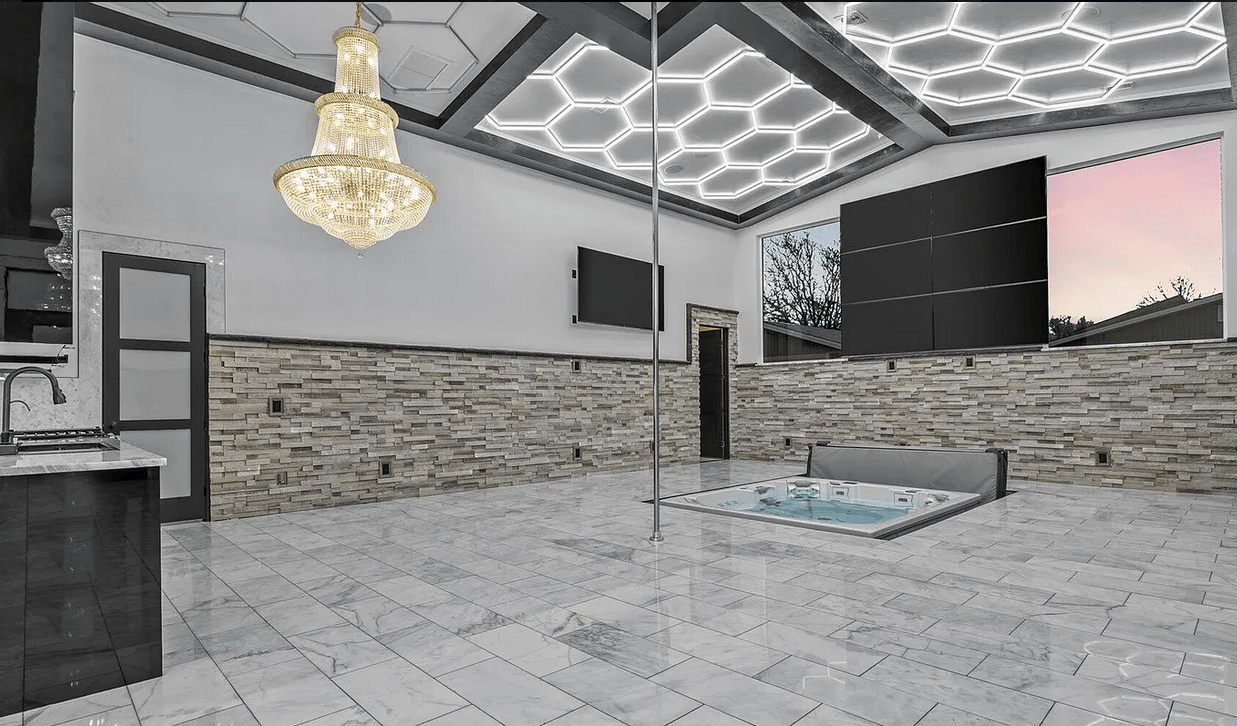

🌍 Dwelling of the Day

True Entertainer's Dream!

2Bed & 2Bath, 2,040sqft on 1.65 Acres

Grand Junction, Colorado, Asking $1.6M

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.