Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Real estate is the art of creating the perfect backdrop for life’s greatest moments.

In today’s edition - Lets dives into crucial topics shaping the economy and housing market. Mortgage rates have surged to their highest in eight weeks, raising concerns for homebuyers. Meanwhile, the U.S. federal deficit hit $1.8 trillion, sparking fiscal warnings. Wall Street braces for a packed week of earnings and key economic data. We explore the housing affordability crisis in swing states and its impact on the upcoming election, along with the continued pivot of homebuilders toward high-density housing. Lastly, renovation projects remain popular, but homeowners face rising costs and delays.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.68% | - |

15-Yr Fixed RM | 6.07% | - 0.02% |

30-Yr Jumbo | 6.78% | - 0.01% |

7/6 SOFR ARM | 6.55% | - |

30-Yr FHA | 6.13% | - |

30-Yr VA | 6.14% | - 0.01% |

Average going rates as of Oct 18 2024

S&P 500 | 5,864.67 | + 0.40% |

10-Yr Bond | 4.0730 | - 0.56% |

Bitcoin USD | 68,637.47 | + 0.78% |

Numbers as of Oct 18 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Federal Deficit Reaches $1.8 Trillion in FY 2024, Debt Set to Soar Further

2024 deficit increase: The U.S. federal deficit for fiscal year 2024 totaled $1.8 trillion, 6.4% of GDP, up from 6.2% in 2023. This marks a $138 billion increase from the previous year’s deficit.

Future debt risks: With national debt standing at $35.76 trillion, both presidential candidates—Kamala Harris and Donald Trump—have proposed policies that would further increase debt, with estimates showing Trump's plan could add $7.50 trillion by 2035, and Harris’ plan $3.50 trillion.

Fiscal outlook and concerns: Moody's warns of a deteriorating U.S. fiscal outlook, projecting deficits of 7-9% of GDP over the next decade, and a debt burden reaching 130% of GDP by 2034. Interest payments on the debt are expected to double as a share of GDP.

Wall Street Investors Gear Up for a Packed Week of Earnings and Economic Data

Earnings Spotlight: Major companies reporting Q3 earnings this week include Tesla, Boeing, Verizon, General Electric, Honeywell, and Coca-Cola, drawing significant attention from investors as markets digest their performance and outlook.

Economic Data in Focus: Key economic indicators will be released, including September's existing and new home sales, October's flash PMIs for manufacturing and services, and the Fed's Beige Book on regional economic activity. These will offer insights into the economy's strength amid persistent inflation concerns.

Market Recap: Last week, US markets showed resilience with the S&P 500 up 0.9%, the Nasdaq rising 0.8%, and the Dow gaining 1%. In the bond market, the yield on the 10-year Treasury dropped slightly to 4.07%.

🎢 Impact on Real Estate

Housing Affordability Crisis Hits Swing States Hardest Ahead of 2024 Presidential Election

Swing state housing burden: Housing prices in battleground states like Arizona, Georgia, and North Carolina have more than doubled since 2019, far exceeding the national home price increase of 48%. This surge is a top concern for voters in these critical states as they head to the polls.

Rental pressures: In North Carolina, particularly New Hanover County, rents have increased by 35% over five years, significantly higher than the national average of 19%. Similar trends are seen across other swing states, affecting 84% of voters in those areas.

Election impact: Both presidential candidates, Kamala Harris and Donald Trump, have made housing a central policy focus. Harris leads slightly on housing affordability solutions in recent polling, but Trump maintains an edge on broader economic issues. Voters across party lines cite housing costs as a major factor in their decision.

🎙️ RE Spotlight

U.S. Home Sales Rise Amid Lower Mortgage Rates, But Higher Prices and Rates Slow Demand

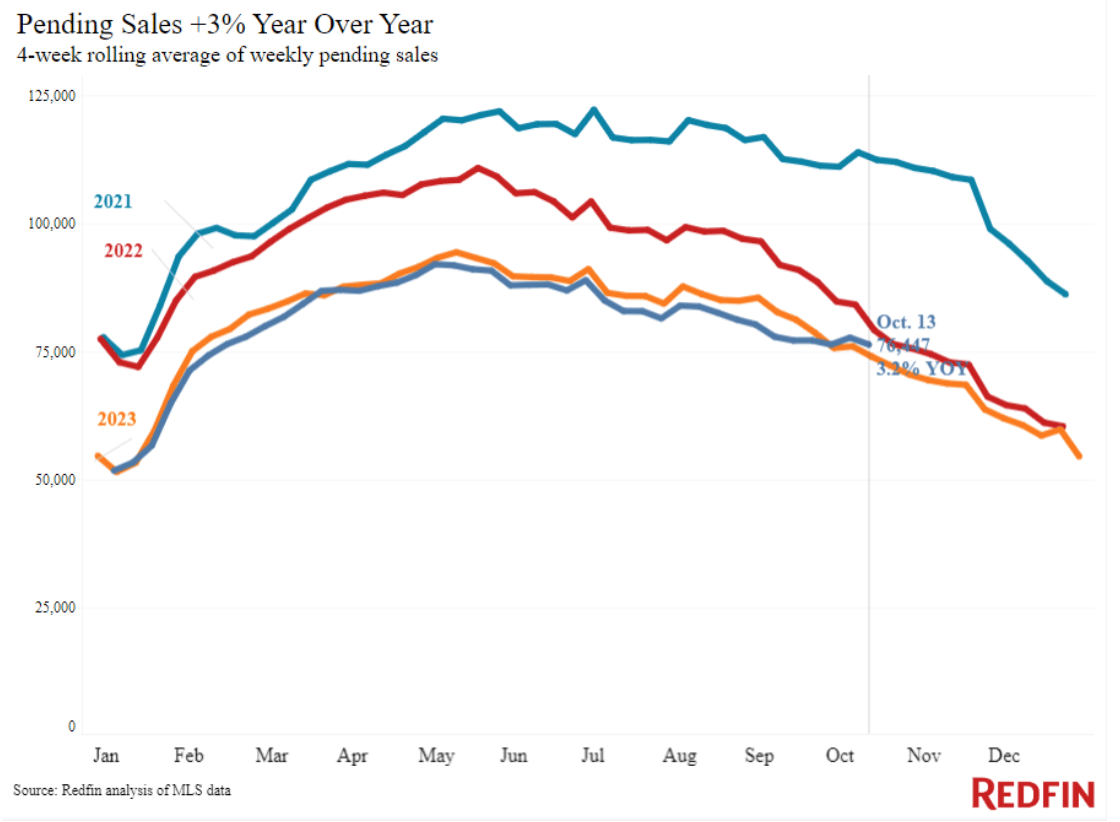

Home Sales Surge: Pending U.S. home sales rose 3.2% year-over-year for the four weeks ending October 13, the largest increase in three years, driven by mortgage rate cuts in late September. This uptick is especially pronounced in California and Portland, OR.

Mortgage Rates on the Rise: The 30-year mortgage rate has climbed back to 6.32%, up from a two-year low of 6.08% at the end of September, driven by a stronger-than-expected jobs report. The median sale price also increased by 4.7% year-over-year, raising monthly mortgage payments for homebuyers by nearly $100.

Shifts in Buyer and Seller Behavior: Rising mortgage rates have flattened buyer demand, with mortgage-purchase applications dropping 7% from a week earlier. Sellers, too, are scaling back with new listings up just 3.6%, the smallest year-over-year increase in a month. Buyers are negotiating more heavily, particularly in markets like Minneapolis, where high rates are prompting sellers to accept lower offers.

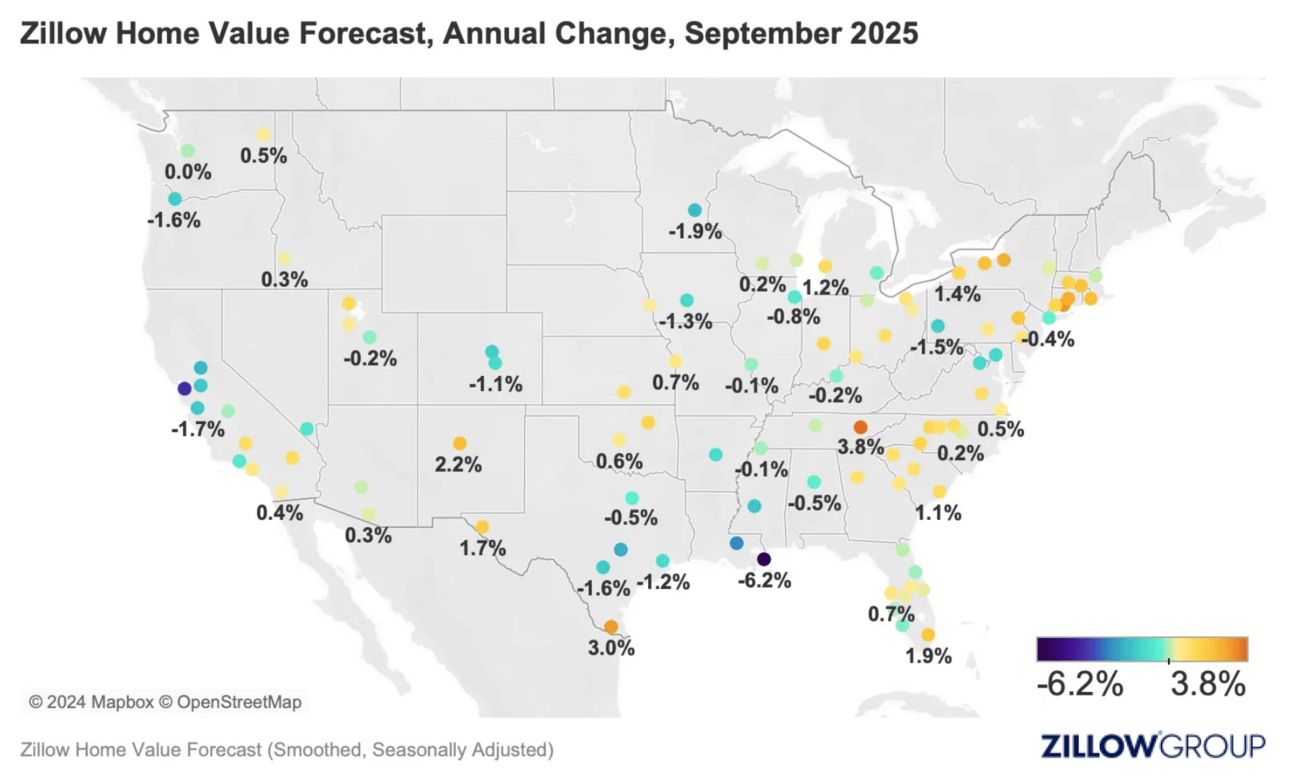

Zillow Home Value and Home Sales Forecast (September 2024)

America’s Renovation Boom Is Leveling Off—but Still Going Strong

Home Renovation Market Stabilizes: U.S. home improvement spending is projected to rise by 1.2%, reaching $477 billion by Q3, signaling a leveling off from the pandemic boom when renovations surged by 10% to 15%.

Top Renovation Drivers: Homeowners are primarily motivated to renovate for comfort (35%), damage repair (35%), and improving livability (32%). Bathroom remodels, interior painting, and HVAC upgrades are the most popular major projects.

Challenges for Homeowners: Despite ongoing demand, 41% of homeowners report delays in their renovation projects, and 78% admit to exceeding their budget—indicating the complexities of managing home improvement expenses.

🏰 RE State Zone

15 Cities Where You Can Find a Rental for Under $1,500 a Month

🏕️ Niche-RE

Fannie Mae Expands Housing Voucher Program to Increase Affordable Housing Access Nationwide

Expanded Housing Choice (EHC) Program Nationwide: Fannie Mae's Housing Choice Voucher program, initially limited to North Carolina and Texas, is now available across all U.S. jurisdictions without source-of-income protections, expanding affordable housing access for low-income families, seniors, and people with disabilities.

Benefits for Property Owners: Borrowers of Fannie-backed multifamily loans who accept housing vouchers can enjoy benefits such as lower pricing, flexible loan terms, reduced turnover and vacancy rates, and competitive, HUD-backed rent payments.

Addressing Housing Inequality: Fannie Mae reports that 30% of voucher holders struggle to find housing that accepts vouchers as a valid income source, and this expansion is a step toward creating a more equitable housing market.

Unlocking the Potential of Church Properties: A New Era for Affordable Housing

Churches across the U.S. hold the key to affordable housing: With shrinking congregations, underutilized church properties offer a unique opportunity to repurpose land for much-needed affordable homes in cities like New York and Los Angeles.

Legislation like California’s SB 4 empowers faith-based housing: New laws are allowing religious institutions to bypass zoning hurdles, unlocking thousands of acres for affordable housing projects that could house families for generations.

Faith-based real estate is reshaping distressed communities: Redeveloping religious properties not only provides housing but revitalizes entire neighborhoods, creating jobs and improving community services like in Louisville, KY's West Jefferson project.

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.