Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Real estate is the heartbeat of communities, connecting people to places.

In today’s edition - we explore the key factors fueling inflation, from the pandemic’s global impact to the stimulus policies that followed. As the economy shifts, we also dive into the housing market trends, mortgage rate fluctuations, and what’s ahead for real estate. With earnings season underway and economic data on the horizon, find out how these elements are reshaping our financial future.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.05% | + 0.03% |

15-Yr Fixed RM | 6.43% | + 0.06% |

30-Yr Jumbo | 7.24% | + 0.04% |

7/6 SOFR ARM | 7.11% | + 0.12% |

30-Yr FHA | 6.39% | + 0.09% |

30-Yr VA | 6.39% | + 0.07% |

Average going rates as of Nov 15th 2024

S&P 500 | 5,870.62 | - 1.32% |

Crude Oil | 66.95 | - 2.55% |

Bitcoin USD (As of Nov 17th) | 90,358.23 | - 0.40% |

Numbers as of Nov 15th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Pandemic, Stimulus, and Inflation: Who’s to Blame?

Pandemic and War as Root Causes: Economists attribute the historic inflation surge—peaking at 8.5% in March 2022—largely to the pandemic's economic fallout and supply chain disruptions, compounded by Russia's invasion of Ukraine. These external shocks drove price spikes and global shortages.

Stimulus: A Double-Edged Sword: The $1.9 trillion stimulus bill under President Biden, alongside earlier rounds under Trump, equaled 20% of GDP. Economists argue it accelerated inflation but was crucial for a rapid economic recovery. Biden’s policy impact ranked low on the blame scale compared to these broader forces.

Inflation Eases, Prices Stay High: Inflation is down to 2.6%, close to the Fed’s 2% target, but prices remain 21.4% higher than pre-pandemic levels. This persistence of high prices shaped voter sentiment, contributing to significant political outcomes in both 2020 and 2024.

Markets Brace for Key Earnings, Housing Data, and Fed Insights

Earnings Spotlight: Big names report this week, with Nvidia's Q3 results (Nov. 20) expected to be a critical gauge for tech and AI stocks. Other giants like Walmart, Target, and Lowe's will reveal Q3 results, highlighting consumer spending trends amidst inflation.

Economic Data Watch: Housing updates take center stage with the Home Builder Confidence Index (Nov. 18) and Housing Starts (Nov. 19). Later in the week, Existing Home Sales and PMI flash reports will provide insights into the real estate and manufacturing sectors.

Fed Speeches Under Scrutiny: Following Jerome Powell’s cautious remarks about future rate cuts, several Fed officials are scheduled to speak, which could further guide market sentiment on monetary policy direction.

🎢 Impact on Real Estate

October Housing Market: Mortgage Rate Rollercoaster Shapes Trends

October Sales Surge Amid Rate Lows - Existing home sales increased 1.6% MoM, hitting the highest seasonally adjusted rate (4.18M) since early 2022. Median home prices rose 5.2% YoY to $435,313, the largest annual jump in six months, driven by September's mortgage rate dip to 6.08%.

Cooling Demand in Late October - Pending home sales dropped 1.1% MoM as mortgage rates rebounded to 6.78%, coupled with election uncertainty. Contract cancellations affected 15.5% of pending deals, the highest rate in nearly a year. The typical home spent 41 days on the market, the slowest October pace in five years.

Metro Market Highlights

Price Growth: Milwaukee (+13.6%), Fort Lauderdale (+13.3%), and St. Louis (+12.2%) led YoY median price gains. Austin (-3.4%) and San Antonio (-1.3%) saw declines.

Sales Boom: Seattle (+26.9%) and Sacramento (+20.1%) showed the strongest increases in closed sales.

Above List Sales: Newark (62.5%) and San Jose (64.4%) had the highest share of homes selling above the asking price.

🎙️ RE Spotlight

Foreclosure Trends October 2024: Key Insights and Regional Hotspots

Foreclosure Activity Rises Monthly but Falls Annually - U.S. properties with foreclosure filings reached 30,784 in October, up 4% MoM but down 11% YoY. Lenders initiated 20,950 foreclosures (+6% MoM, -10% YoY), while completed foreclosures (REOs) totaled 2,938 (+12% MoM, -12% YoY).

State and Metro Foreclosure Rates

Highest Rates: Nevada (1 in 2,741 homes), New Jersey (1 in 3,059), and Florida (1 in 3,086).

Metro Hotspots: Vallejo, CA, had the nation’s highest rate (1 in 1,464 homes). For cities >1M population, Riverside, CA (1 in 1,978 homes), led.

Regional Foreclosure Starts and Completions

Top States for Starts: California (2,915), Texas (2,282), and Florida (2,227).

Highest REOs: California (306), Illinois (252), and Texas (249). Notably, Chicago recorded 162 REOs—the highest among large metros.

Gen X Homebuyers: Future-Proof Your Retirement with Accessible Homes

Prioritize Single-Floor Living: Homes with single-level layouts and wide doorways ensure mobility-friendly spaces, perfect for aging in place and accommodating multigenerational families.

Bathroom Safety is Essential: Features like grab bars, non-slip flooring, and wheelchair-accessible showers reduce fall risks and make everyday routines safer for retirees.

Leverage Financial Tools for Renovations: Use HUD grants or reverse mortgage proceeds to fund home modifications; major retailers like Lowe’s and The Home Depot now offer accessible products for easy upgrades.

🏰 RE State Zone

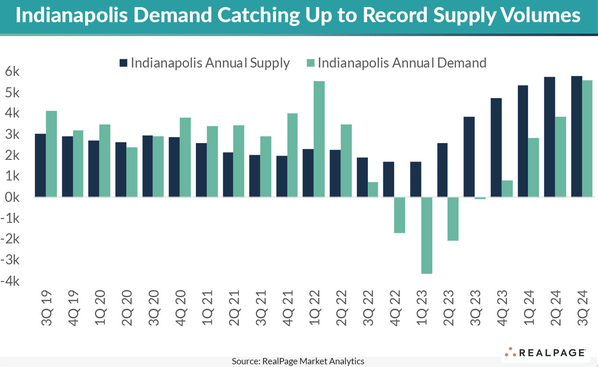

Indianapolis Apartment Construction Trends 2024: A Shift to Historical Norms

Sharp Decline in Construction Starts: Indianapolis saw only 1,300 apartment units begin construction in the year-ending Q3 2024, the lowest since early 2020 and a steep drop from 6,000 units annually in 2022 and 2023.

Localized Construction Activity: In 2024, Carmel/Hamilton County and Downtown Indianapolis accounted for all new starts, contrasting with 2023's broader eight-submarket activity.

Supply and Demand Rebalancing: With a record 5,760 new units delivered and 5,600 absorbed in the past year, demand has caught up to elevated supply, reflecting Indianapolis' affordability and strong population growth.

🏕️ Niche-RE

October Construction Input Prices Rise by 0.3%, Led by Energy Costs. ABC.ORG

Energy Costs Drive Construction Price Increases: Energy-related materials saw substantial price hikes, with natural gas jumping 29.3%, unprocessed energy materials rising 9.9%, and crude petroleum climbing 7.3%. This surge contributed to a 0.3% increase in overall construction input prices for October.

Year-Over-Year Construction Input Prices Still Lower: Despite the monthly increase, overall construction input prices are 0.2% lower compared to October 2023, and nonresidential construction input prices decreased by 0.5%, signaling a moderation in cost growth year-over-year.

Uncertainty Ahead for 2025 Construction Costs: With shifting trade policies and potential tariff impacts looming, construction material costs may experience short-term volatility. Contractors remain optimistic for profit margin expansion into Q1 2025, but the evolving market conditions warrant close attention.

🖼️ Chart-Tastic

👾 Interesting in Social

Who should we reach out to if we suspect we have been the victim of a predatory loan deal? Who would you report the mortgage company and the real estate agent to in this case? We are in Christmas Valley, OR

Always Know Your Rights

One Reader Responded, Read Full Details Below.

🌍 Dwelling of the Day

Never Seen Anything Like it, Have you?

Reply to tell me, what should a buyer look for in this property before sending an offer. I will share your comments in the next edition.

3Bed and 3Bath, 3,720sqft, 3.02acre lot

Asking $549,000 in Plymouth, WA. Link to the Listing

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.