Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - A home is where love resides, memories are created, and life unfolds.

In today’s edition - Fed signals caution on further rate cuts due to a resilient economy, while the Nasdaq leads declines amid a chip stock selloff. Young adults are fueling growth in small towns, reversing migration trends. RealPage projects steady apartment demand with mild rent growth. Detroit tops the rental market charts, while 7-Eleven announces widespread closures. Hispanic homeownership continues to rise, building wealth and overcoming challenges. Plus, dive into 500 years of interest rate history, and explore an extraordinary estate as our featured property.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.62% | - 0.02% |

15-Yr Fixed RM | 6.07% | - 0.03% |

30-Yr Jumbo | 6.74% | - 0.01% |

7/6 SOFR ARM | 6.55% | - |

30-Yr FHA | 6.09% | - 0.03% |

30-Yr VA | 6.10% | - 0.03% |

Average going rates as of OCT 15 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Fed Governor Says 'more caution' Needed on Rate Cuts, Data Showing a Hot Economy

Cautious approach after jumbo cut: Following last month’s 50-basis point cut, Fed Governor Waller signals the need for a more cautious pace of easing, citing a stronger-than-expected economy.

Hot economic data: Waller points to robust employment growth, sticky inflation, and upward revisions in GDP and income as signs the economy may not be cooling as quickly as desired.

No-landing scenario: With expectations of continued economic growth, traders are eyeing upcoming retail sales data for clues on whether inflation will remain elevated, complicating further rate cuts.

Nasdaq Leads Stock Declines as Nvidia, Chip Stocks Sell Off

ASML leads chip selloff: ASML Holding shares plummet over 15% after early-released earnings reveal a disappointing sales outlook for 2025, impacting the broader semiconductor sector, with Nvidia (NVDA) and AMD (AMD) both dropping 5%.

Broad market decline: The Dow Jones Industrial Average (^DJI) slid 0.8%, losing over 300 points, weighed down by an 8% fall in UnitedHealth Group (UNH). The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) both dropped 0.8% and 1%, respectively.

Bank earnings surprise: Goldman Sachs (GS) reported a 45% surge in third-quarter profits, while Bank of America (BAC) also posted an earnings beat, providing some positive sentiment despite a tough earnings season ahead.

Energy sector focus: Oil prices fell around 4%, with West Texas Intermediate crude futures dropping below $71 after reports that Israel may refrain from attacking Iran’s energy infrastructure.

🎢 Impact on Real Estate

Young Adults Have Fueled the Revival of Small Towns and Rural Areas

Reversal in migration trends: Unlike the decades following 1980, when large metro areas drew the majority of young adults, the 2020s have seen small towns and rural areas attract the highest rate of younger adult migration in nearly a century.

High-amenity areas thrive: Counties with natural amenities like the Colorado Rockies and Georgia’s Blue Ridge Mountains are experiencing workforce growth at twice the national rate. Incomes in these areas have also surged three times faster than the national average since the pandemic.

New economic opportunities: Remote work has fueled geographic flexibility, leading to a 13% faster increase in new business applications in small metro areas and rural counties, particularly in regions like Virginia's Chesapeake Bay and Southwest Virginia.

🎙️ RE Spotlight

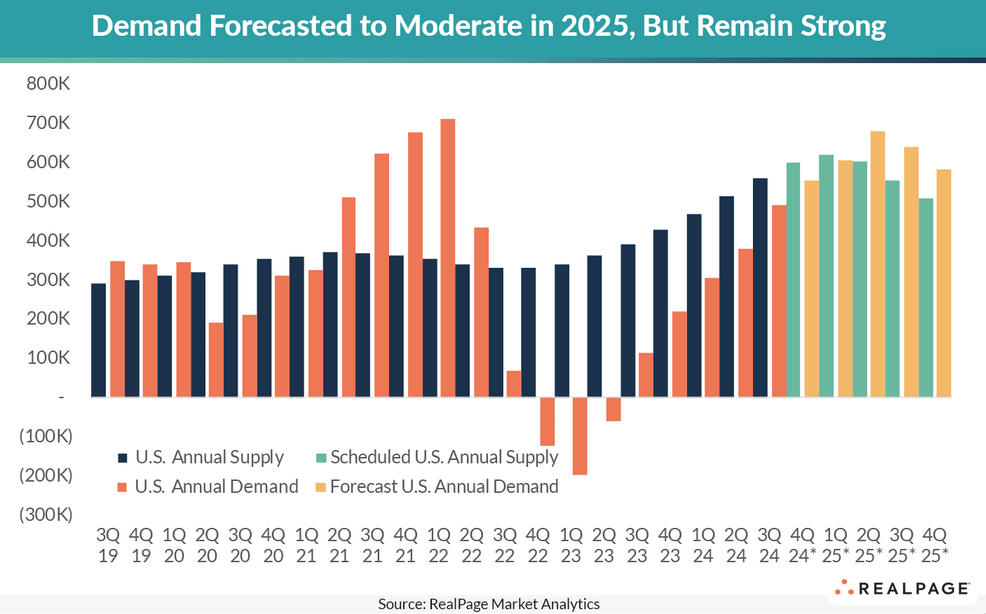

RealPage Forecast Indicates Strong Demand, More Mild Rent Growth

Employment surge boosts demand: September ended with a job increase of 254,000, bringing total job creation in 2024 to 1.8 million. Strong demand for apartments followed, with over 192,000 units absorbed in Q3, and over 488,000 units absorbed year-to-date.

Supply remains high, rent forecasts downgraded: Over 637,000 apartments are expected to be delivered in the next year, resulting in rent cuts for 68% of the top 50 markets in 2024. Rent growth between 1%-3% is projected for half of the markets by year-end.

2025 outlook improves slightly: As supply begins to slow, 2025 rent growth forecasts show that nearly half of the top 50 markets will see rent growth between 2%-3%, with over 35% expected to see growth exceeding 3%.

🏰 RE State Zone

Detroit Tops the List of Most In-Demand Rental Markets as Southern Cities Surge

Detroit takes the top spot: After a sharp rise in engagement, Detroit becomes the most sought-after city for renters in September, with page views up 16% and available listings down 38%.

The South rises in popularity: 11 Southern cities made it to the top 30 rental markets, with Atlanta (#4), Fayetteville (#7), and Winston-Salem (#8) gaining attention.

Hialeah’s comeback: After a long absence, Hialeah, FL, reenters the top 30 with a remarkable 58-spot jump, showcasing renewed interest from renters.

🏕️ Niche-RE

7-Eleven Parent Company to Close 444 Stores Amid Restructuring Efforts

Store closures announced: Seven & i Holdings will shutter 444 underperforming 7-Eleven locations across the U.S. and Canada, representing 3% of its North American presence.

Financial impact: The closures are expected to generate $30 million in operating income this year and $110 million in revenue from store sales.

The Rise of Hispanic Homeownership: Building Wealth and Overcoming Challenges

Hispanic homeownership growth: Despite a dip in 2023, the Hispanic homeownership rate has risen 5.8% over the past decade, reaching 51%.

Economic drivers: Improved educational attainment (+2.1M college graduates) and rising incomes (+67%) are key contributors to homebuying among Hispanic households.

Wealth creation: Hispanic homeowners have accumulated over $180,000 in home equity in the last decade, driving intergenerational wealth, especially in states like New Mexico (67% homeownership) and Texas.

🖼️ Chart-Tastic

500 Years of Interest Rates

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.