where real property meets real data, every day

In This Edition

Mortgage Rates Drop, Housing Affordability Challenges

Ranking of Student Housing Rents by State

Zillow Looks into a Future

Tampa Bay Ranked Most Popular

and more inside

Regional: North Carolina Market Snapshot

Economic: Fed’s Powell said 2% inflation nonnegotiable

New? Join our newsletter – no cost!

Mortgage & REITS

30-Yr Fixed RM | 6.63% | + 0.05% |

15-Yr Fixed RM | 6.15% | + 0.12% |

30-Yr FHA | 6.17% | + 0.02% |

30-Yr Jumbo | 6.75% | + 0.03% |

7/6 SOFR ARM | 6.48% | + 0.18% |

30-Yr VA | 6.20% | + 0.03% |

Average going rates as of Aug 8th 2024

S&P 500 | 5,319.31 | + 2.30% |

S&P REIT | 354.13 | + 1.13% |

FTSE NAREIT | 784.27 | + 0.85% |

Numbers as of Aug 8th 2024 closing

Economic Rundown

The Fed’s Powell said his 2% inflation target was nonnegotiable. Jamie Dimon is skeptical it’s even possible

As the Fed navigates between controlling inflation and managing rising unemployment, real estate investors face growing uncertainty. JPMorgan Chase CEO Jamie Dimon warns that future economic factors could keep inflation elevated, making the Fed’s task challenging. Potential rate cuts might boost borrowing and impact property prices. Staying informed and adaptable is key as these macroeconomic shifts could shape real estate opportunities in the coming months.

"It is the Fed's job to bring inflation down to our 2% goal, and we will do so," he said.

Real Trends

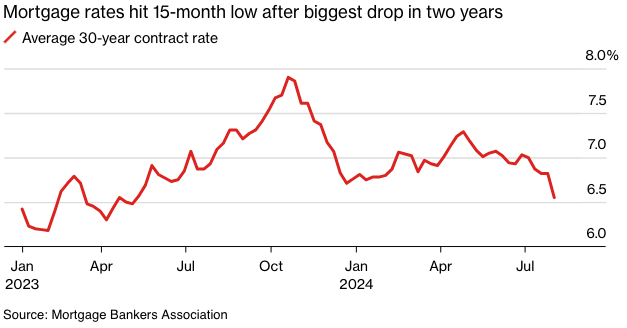

Mortgage Rates Drop, But Housing Affordability Challenges Persist

Recent dip to a 15-month low of 6.55% offers relief for potential homebuyers, down from April’s 7.29% peak but still double the sub-3% rates seen during the pandemic.

Despite lower rates, housing affordability remains a challenge with median home prices up 37% compared to 2019, and monthly mortgage payments averaging $2,500, up nearly 60% since pre-pandemic levels.

86% of swing-state voters now rank housing as a key issue, highlighting the importance of staying informed on mortgage trends and potential policy shifts to navigate this dynamic market.

Spotlight

Average Student Housing Rents Ranked by State: Fall 2023

New York tops the list as the most expensive state for student housing, with average rents reaching nearly $2,500 per bed per month, while Wyoming offers the most affordable rates at under $550 per month. On average, rents in privately-owned student housing across 175 universities hover around $1,000 per month, though costs vary widely. Massachusetts and Washington, DC, join New York with some of the highest rates, while states like Montana have seen significant rent increases, reflecting broader apartment rent trends. Meanwhile, West Virginia, Kansas, North Dakota, and Wyoming remain the most affordable options, with rents below $600 per month.

Zillow Looks Into a Future with Jeremy Wacksman at the Helm

Zillow has promoted Jeremy Wacksman to CEO, with co-founder Rich Barton transitioning to co-executive chair, focusing on strategic support and future opportunities.

Zillow achieved a 13% revenue increase to $572 million in Q2 2024, driven by significant growth in rental revenue (+29%) and mortgage origination volume (+125%), despite a $17 million net loss.

Zillow is enhancing its "Housing Super App" and expanding market coverage, aiming for double-digit revenue growth in 2024 while continuing to innovate in technology to improve the homebuying experience.

“We continue to believe our more important investments are in tech innovations that improve the customer experience, which has helped us earn and maintain our strong brand position and massive engaged audience of movers,” Wacksman added.

Regional Zone

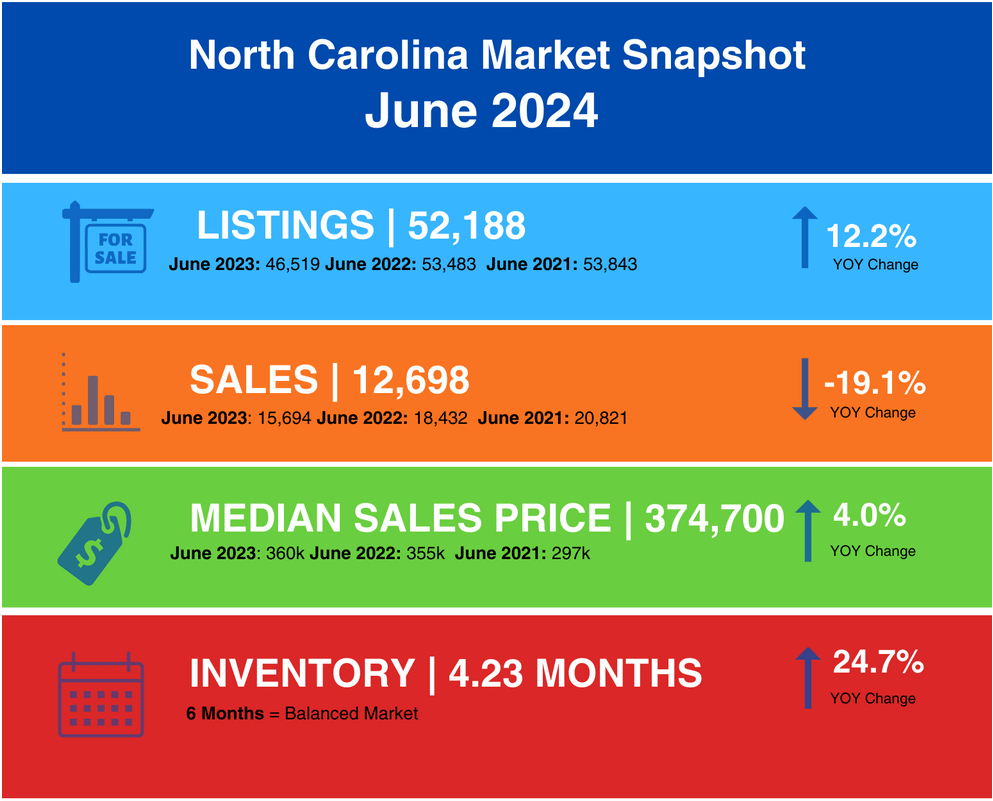

While the number of home listings and home sales prices continue to increase in North Carolina, there was a substantial decrease in home sales in June. New home listings were at 52,188 in June, a slight increase over the month before and up 12% year over year. The median sales price increased 4% to $374,700 year over year, yet overall sales were down 19%. North Carolina is still a seller’s market; homes are staying on the market for an average of 4.23 months. Continue to Housing Report

More Stories

Equity Residential has purchased a 320-unit multifamily property in Atlanta for $126.25 million.

Tampa Bay Ranked Most Popular Place to Live"It's not hard to understand Tampa's appeal. It checks many of the boxes that make a place desirable," Clever wrote.

A Widewail report highlights the important role on-site teams play in garnering positive renter sentiment.

“This was land adjacent to a warehouse facility,” said Shalek, now a principal of the real estate investment firm Ridgecut Road alongside his brother, Scott Shalek.

Interesting in X

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.