Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Resilient markets thrive on informed decisions—adapt, innovate, and grow.

In today’s edition - Explore how U.S. and Canadian economies are defying odds in 2024, with steady GDP growth and strong labor markets driving consumer confidence. Discover the impact on mortgage rates, housing prices, and inventory trends. From luxury senior living developments to Tennessee's booming real estate market, this edition covers the insights that matter most to investors and homeowners.

If you missed yesterday’s newsletter, click here

In-depth Analysis of Credit Trends Unveiled: Credit Cards, Mortgages, Personal Loans, Auto Loans

Rates & REITS

30-Yr Fixed RM | 6.68% | - 0.16% |

15-Yr Fixed RM | 5.98% | - 0.04% |

30-Yr Jumbo | 6.98% | - 0.02% |

7/6 SOFR ARM | 6.60% | - 0.12% |

30-Yr FHA | 6.12% | - 0.07% |

30-Yr VA | 6.13% | - 0.07% |

Average going rates as of Dec 6 2024

S&P 500 | 6,097.25 | - 0.03% |

10-Yr Bond | 4.1510 | - 0.69% |

Bitcoin USD ( As of Dec 8th Closing) | 99,921.69 | - 0.01% |

Numbers as of Dec 6 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Soft Landing Ahead: U.S. and Canadian Economies Stay Resilient in 2024 and Beyond

Steady Economic Growth: U.S. GDP growth averaged 2.5% in 2024, with Q4 forecasted at 3.3%, while Canadian economic trends mirror resilience. Wage growth surpassing inflation supports consumer spending, driving 70% of U.S. GDP and 55% of Canadian GDP.

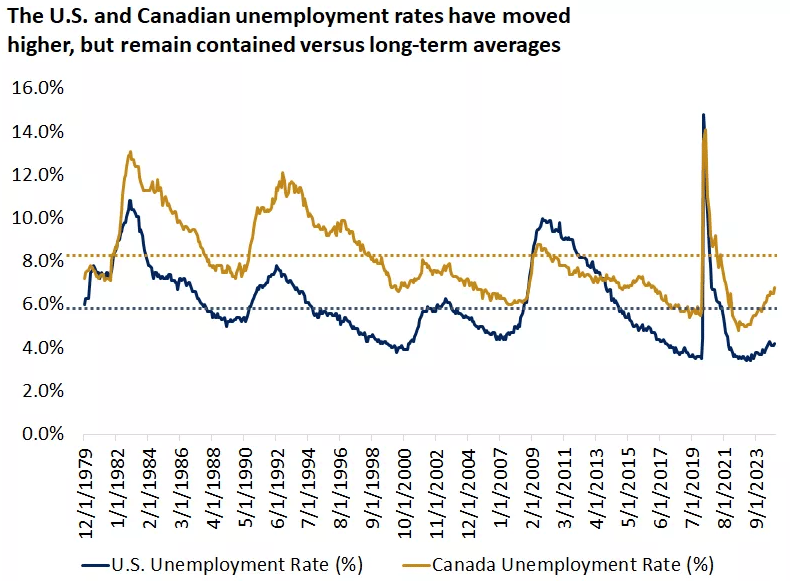

Robust Labor Markets: The U.S. added 227,000 jobs in November, surpassing expectations, while Canadian employment rose by 51,000. Unemployment remains below long-term averages, supporting confidence and spending.

Opportunities Amid Uncertainty: With policy and market volatility likely in 2025, short-duration bonds and sector-diverse U.S. stocks are recommended to capitalize on a solid-growth environment supported by rate cuts and resilient consumer demand.

🎢 Impact on Real Estate

Mortgage Rates To Stay Above 6% as Home Prices Grow

Mortgage Rates Stabilize Above 6%: Mortgage rates will average 6.3% in 2025, slightly lower than the 6.7% in 2024, but still far above the historical average of 4% (2013–2019), maintaining affordability challenges for buyers.

Home Prices and Inventory Increase: Home prices are set to rise by 3.7% in 2025, alongside an 11.7% jump in inventory, with 1.1 million new construction units—the highest growth in years, easing market pressures.

Rents Stabilize with Rising Vacancy Rates: Asking rents are predicted to decline by 0.1%, as a robust multifamily construction pipeline pushes the rental vacancy rate toward the pre-pandemic average of 7.2%.

🎙️ RE Spotlight

What to Expect From the DMV Real Estate Market in 2025

1. Sales and Inventory Growth Amid Price Increases

Home sales in the DMV are projected to rise by 7.9%, from 49,630 in 2024 to 53,550 in 2025.

Inventory is expected to jump 14%, with active listings increasing from 5,710 to 6,507.

Median home sale prices are forecasted to climb by 4.7%, reaching $638,310 in 2025.

2. Market Dynamics: Mortgage Rates and Buyer Behavior

Lower mortgage rates could unlock inventory as sellers feel more comfortable listing their homes.

However, pent-up buyer demand will keep prices high, countering affordability gains from rate drops.

3. The Work-From-Office Shift

Increased IRL work mandates, led by federal and private employers, may drive workers closer to offices, influencing DMV sales activity.

Bright MLS cites this shift as a significant factor in the uptick in home sales.

Challenges to Watch:

Economic uncertainty and rate volatility could temper market growth, affecting both buyers’ and sellers’ confidence.

Despite improvements, sales and inventory levels will remain below pre-COVID benchmarks.

Tennessee's 2025 Housing Forecast

1. Home Prices and Sales Trends

Home prices in Tennessee are expected to rise by 3.7% nationwide and 6.3%–10.5% across key metro areas, with Memphis leading at 10.5% price growth.

Sales volume is anticipated to increase by 1.5% nationwide, while Tennessee metro areas like Nashville (+4.5%) and Knoxville (+3.7%) drive growth.

2. Mortgage Rates and Affordability Challenges

Mortgage rates are predicted to average 6.3% in 2025, slightly below 2024's 6.7% but still high compared to pre-pandemic levels.

Homeownership rates may dip slightly from 65.6% to 65.3%, with affordability challenges continuing, especially for first-time buyers.

3. Rental Market Outlook

Tennessee will see the highest rental stock growth in the South at 1.5%, but affordability issues persist with minimal changes to rental prices (0.1% decrease).

Multifamily construction is increasing, but rental vacancy remains tight at 6.9% in 2024, keeping rental options competitive.

🏰 RE State Zone

Influencer Mom’s $18,000 Monthly Rent for Two Apartments Sparks Debate

1. Luxury Living or Excess?

TikTok influencer Kristi (@kristiipartyof6) rents a second Manhattan apartment for $6,000/month to use as a storage unit, playroom, and closet.

Combined with the $12,000/month rent for her primary residence, the family pays $18,000 monthly, igniting criticism about practicality and excess.

2. Cost Comparisons and Viewer Reactions

Critics questioned why Kristi doesn’t invest in a townhouse or larger home, noting the $1.5M median property price in Manhattan offers mortgage options at $9,772/month (30-year fixed, 20% down).

Kristi defended the arrangement as a luxury aligned with her family’s desire to stay in their community while maintaining their Utah home for summers.

3. Balancing Lifestyle and Perception

Kristi acknowledges her setup is a "huge luxury", contrasting New York City living norms with those in more affordable regions.

The backlash highlights public fascination—and frustration—with influencers’ unconventional spending decisions, especially in high-cost urban markets.

🏕️ Niche-RE

The 'Silver Tsunami' and Housing Inventory: Why It’s Not the Solution We Hoped For

Mismatch in Housing Demand and Supply: Zillow data shows that 12.8 million "empty nest" homes are concentrated in affordable markets like Pittsburgh and Cleveland, rather than high-demand urban job centers like Seattle or Austin. This limits the impact of senior-driven inventory on the housing shortage.

Affordability Challenges Persist: Expensive markets, where housing is scarce, won’t benefit significantly from seniors downsizing. Zillow highlights that areas with land use restrictions and limited new builds exacerbate the affordability crisis, emphasizing the need for stronger supply expansion.

Policy and Infrastructure Implications: Coastal and high-growth markets require denser construction and down payment assistance to improve access to homeownership. Meanwhile, retirement hotspots like Florida and South Carolina face rising infrastructure challenges as they prepare for a growing senior population.

Senior Living Developments Across the U.S.: Luxury, Affordability, and Innovation in 2024

Record-Breaking Financing in Irvine: The James, a luxury senior living community in Irvine, secured $473 million in tax-exempt financing—the largest nonprofit single-site bond issue in history. It will feature 350 units with high-end amenities, making it the first senior living project in Irvine in nearly three decades.

Affordable Housing Milestone in Florida: Sol Vista, a new 227-unit affordable senior housing community in Miami-Dade County, is reserved for seniors earning no more than 60% of the area median income, ensuring accessibility alongside modern amenities like energy-efficient appliances and secure access.

Expansions and New Concepts Nationwide: Notable developments include:

Altis at Serenity in Raleigh, NC: 425 homes designed for 55+ adults with customizable layouts.

The Gallery at South Tampa: A 240,613 sq. ft. development featuring resort-style amenities and a focus on wellness and creativity.

Choreograph Gainesville in Florida: A resort-style 55+ community with rooftop lounges, outdoor yoga studios, and a vibrant social setting.

These developments reflect a growing demand for both luxury and affordable senior living options, prioritizing lifestyle, accessibility, and innovation.

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.